Research & Analysis

Bank of Canada Rate Decision and Market Impact

- 2024-09-03

- Share On:

-

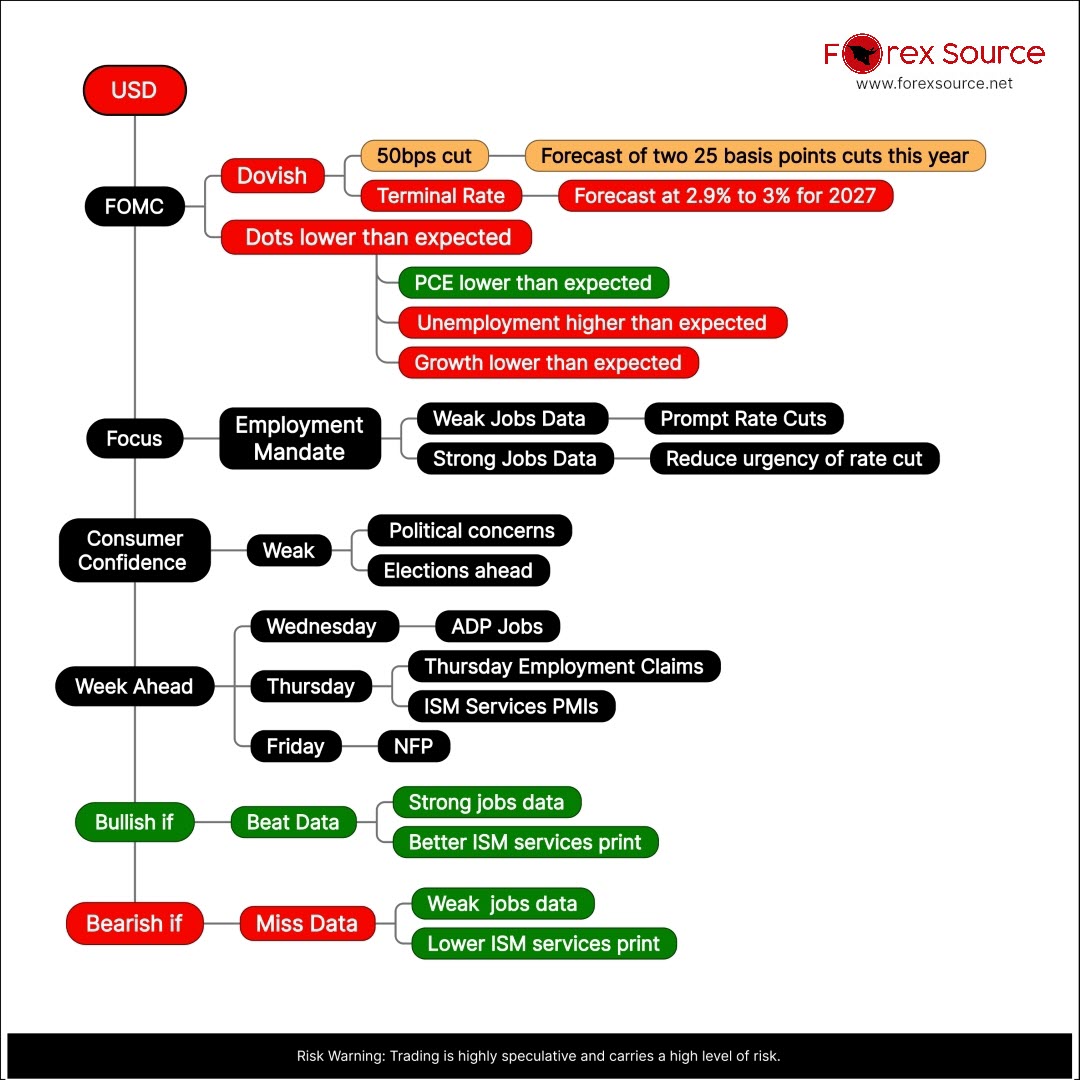

Rate Cut Expectations:

The Bank of Canada's expected decision involves either a 25 basis points cut to 4.25% or a more aggressive 50 basis points cut to 4.00% .

[shortcode-o25spmgc]

[shortcode-usuxmrhr]

[shortcode-t7jeoivo]

[shortcode-mgtd61rt]

Economic Indicators:

Factors driving these expectations include a decrease in inflation, The average CPI has slowed to 2.43%, and an increase in unemployment rates, which have risen throughout the year.

[shortcode-rvb58h9s]

[shortcode-ayl9hyns]

[shortcode-zh3ge7gn]

Implications for CAD:

Higher mortgage renewal rates could lead to increased debt servicing costs for Canadian consumers, suggesting a bearish outlook for the Canadian dollar.

[shortcode-q2efx7se]

[shortcode-hpgwuu1d]

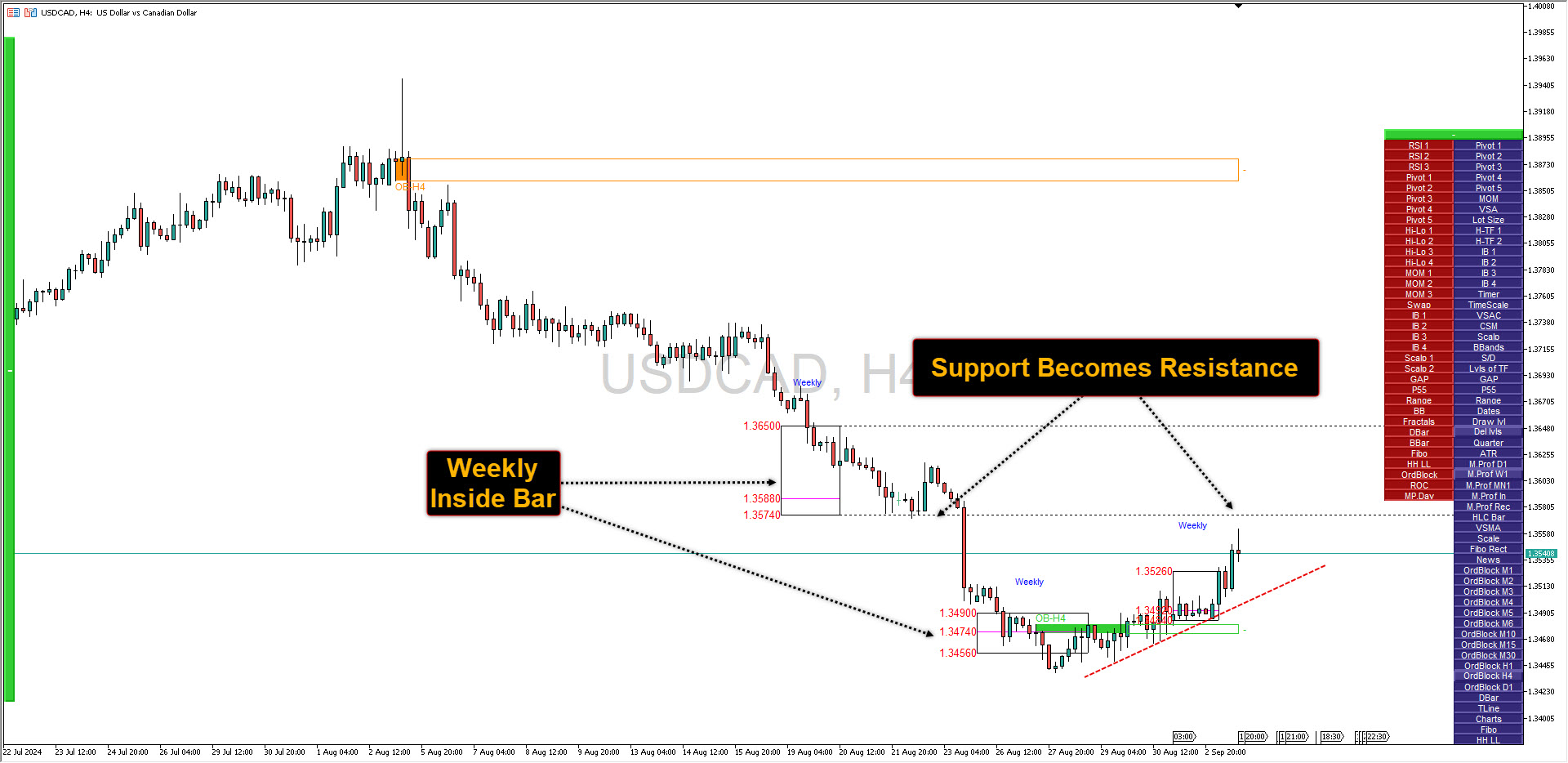

Market Reactions:

- A 50bps Cut could lead to immediate selling of CAD, boosting currency pairs like USDCAD and encouraging selling of CADJPY.

- A 25bps Cut, if accompanied by signals of further rate cuts, might maintain pressure on CAD, though this outcome is largely anticipated.

- If the BoC Holds the rate, highlighting caution over rapid rate reductions, the CAD might strengthen sharply, encouraging USDCAD selling and signaling a surprise in the market.

[shortcode-xqbx2kpk]

Recently Blog