Research & Analysis

What to Expect from the Upcoming NFP Report

- 2024-10-04

- Share On:

-

- The ADP jobs report was strong this week, contributing to a mixed unemployment outlook.

- The JOLTS data appears robust, but the focus remains on the Non-Farm Payroll (NFP) report.

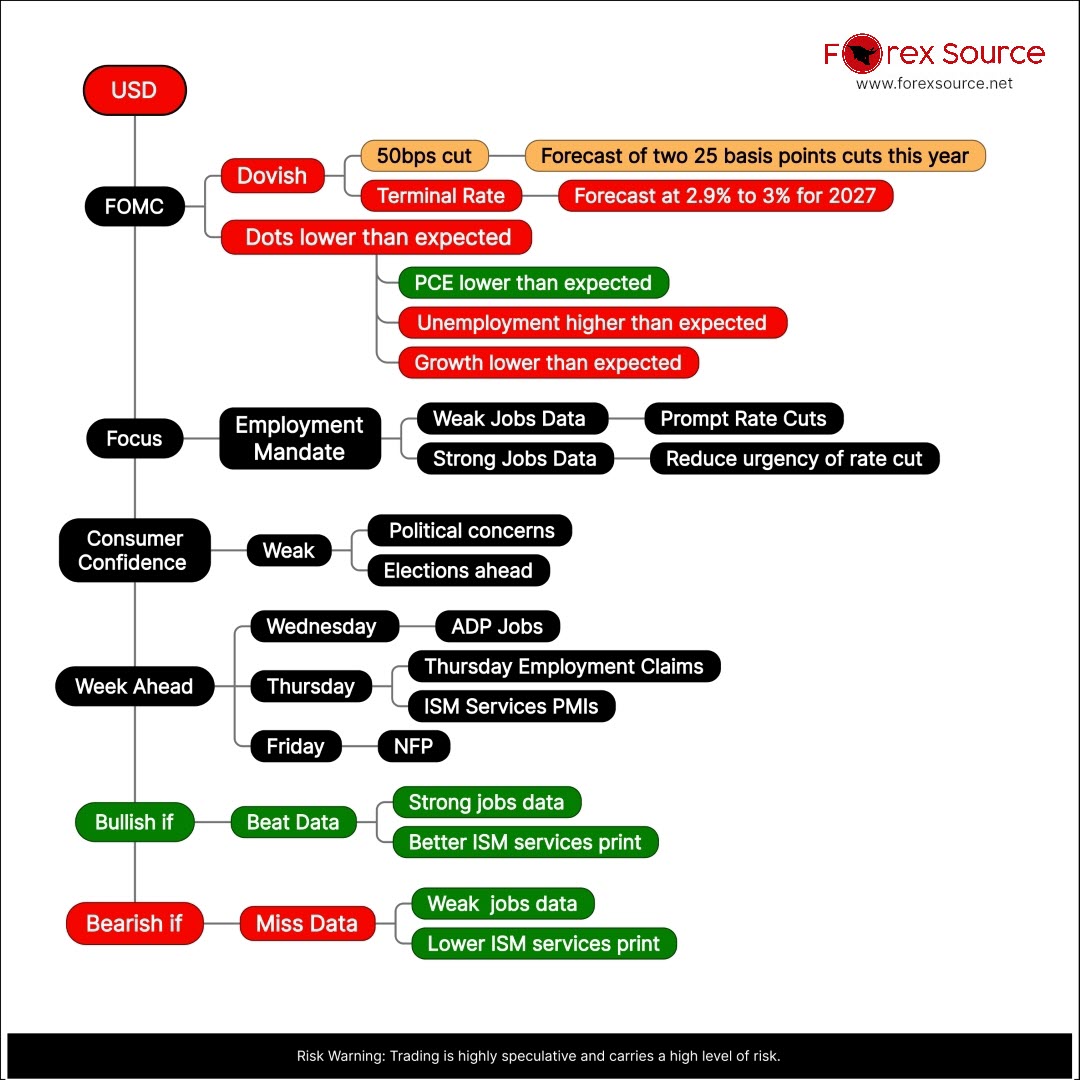

- Current market expectations suggest a 66% chance of a 25 basis point (bps) rate cut by the Federal Reserve.

- A strong jobs report is expected to increase the likelihood of a 25 bps cut, which would strengthen the USD, while a weak report could heighten the chances of a 50 bps cut, negatively impacting the USD.

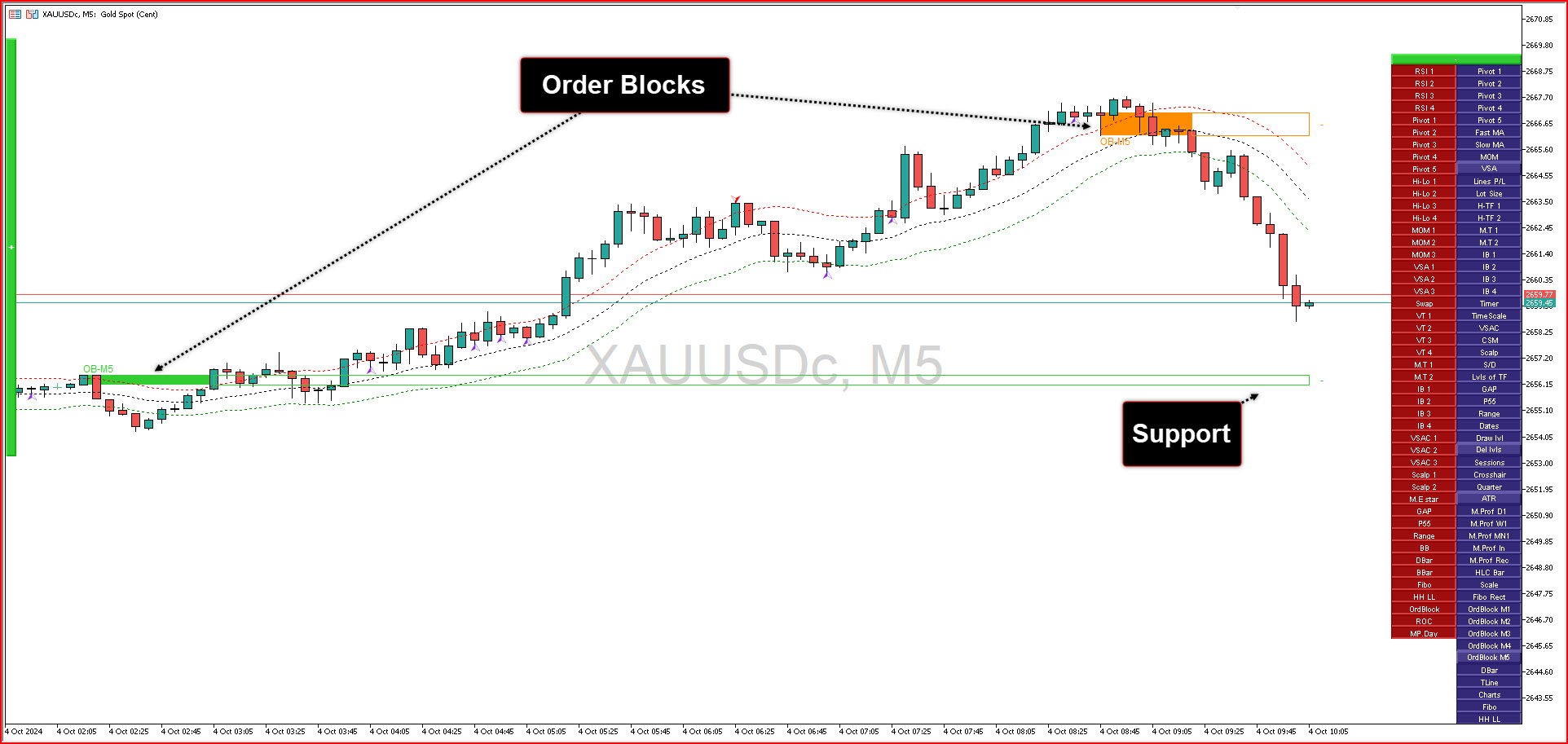

- Given geopolitical risks, shorting the USD may not be advisable; however, gold prices could rise with a weaker USD and geopolitical tensions.

- Forecast Indicators:

- Weak Print Expectations:

- NFP: 99K or below

- Unemployment Rate: 4.4% or higher

- Average Earnings (Y): 3.6% or lower

- Unchanged revisions suggest gold buying.

- Strong Print Expectations:

- NFP: 181K or above

- Unemployment Rate: 4% or lower

- Average Earnings (Y): 3.9%

- Unchanged revisions suggest selling EURUSD.

- Weak Print Expectations:

[shortcode-uouyudzu]

-----------------------------------------------------------------------

[shortcode-cjrqoat5]

-----------------------------------------------------------------------

[shortcode-hf5j0sma]

-----------------------------------------------------------------------

[shortcode-wow9nykf]

Recently Blog