Research & Analysis

Eurozone Economic Shifts: ECB Rate Cut Predictions

- 2024-08-28

- Share On:

-

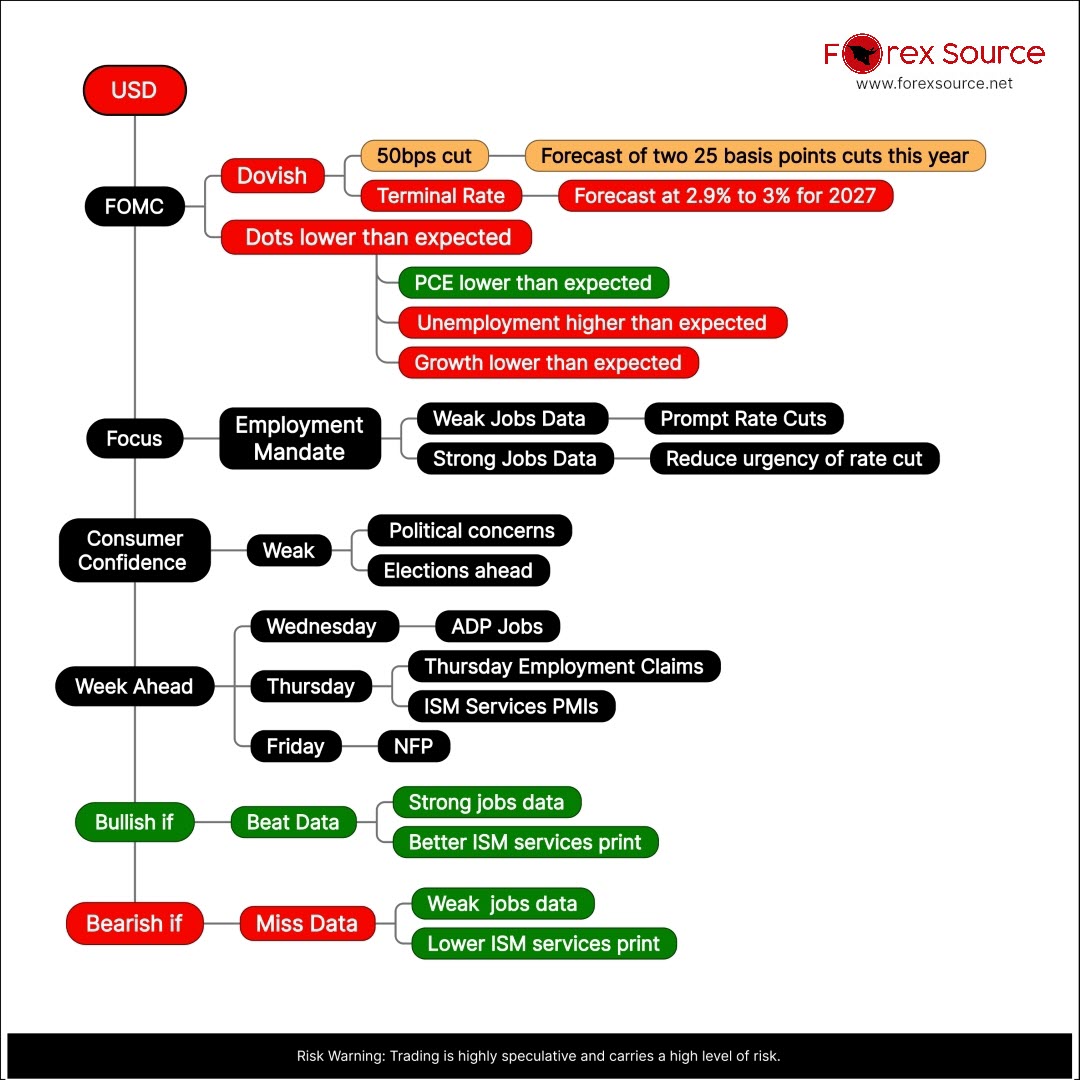

The Eurozone's economic growth is currently lagging behind that of the US and the UK. While both the US and the UK economies are experiencing faster growth, which naturally contributes to inflationary pressure, the Eurozone has been more sluggish in comparison. This slower growth in the Eurozone reduces the inflationary risks that are more prevalent in faster-growing economies like the US and the UK. As a result, while the US and UK maintain higher interest rates to manage this inflation, the Eurozone has more leeway to consider lowering rates due to its slower growth and consequently lower inflation pressures.

[shortcode-ychdhf1p]

Need to know

- The European Central Bank (ECB) is considering 3 rate cuts.

[shortcode-affqtt13]

[shortcode-libqvrjj]

- Recent data shows cooler-than-expected inflation, resulting in market predictions of up to three rate cuts remain for the year.

- Economic growth disparities are notable, with the US and UK growing faster than the Eurozone.

- Inflation in the Eurozone is expected to drop to 2.2% from 2.6%, partly due to high past energy costs.

[shortcode-hgpxjrkl]

[shortcode-kdawfbf1]

[shortcode-avtexsgj]

[shortcode-j3wbljhf]

Recently Blog