Research & Analysis

Market Insights: Fed Rate Cuts, Global Economies, and Currency Trends

- 2024-08-28

- Share On:

-

Understanding Recent Market Trends: Fed's Rate Cuts and Global Economic Updates

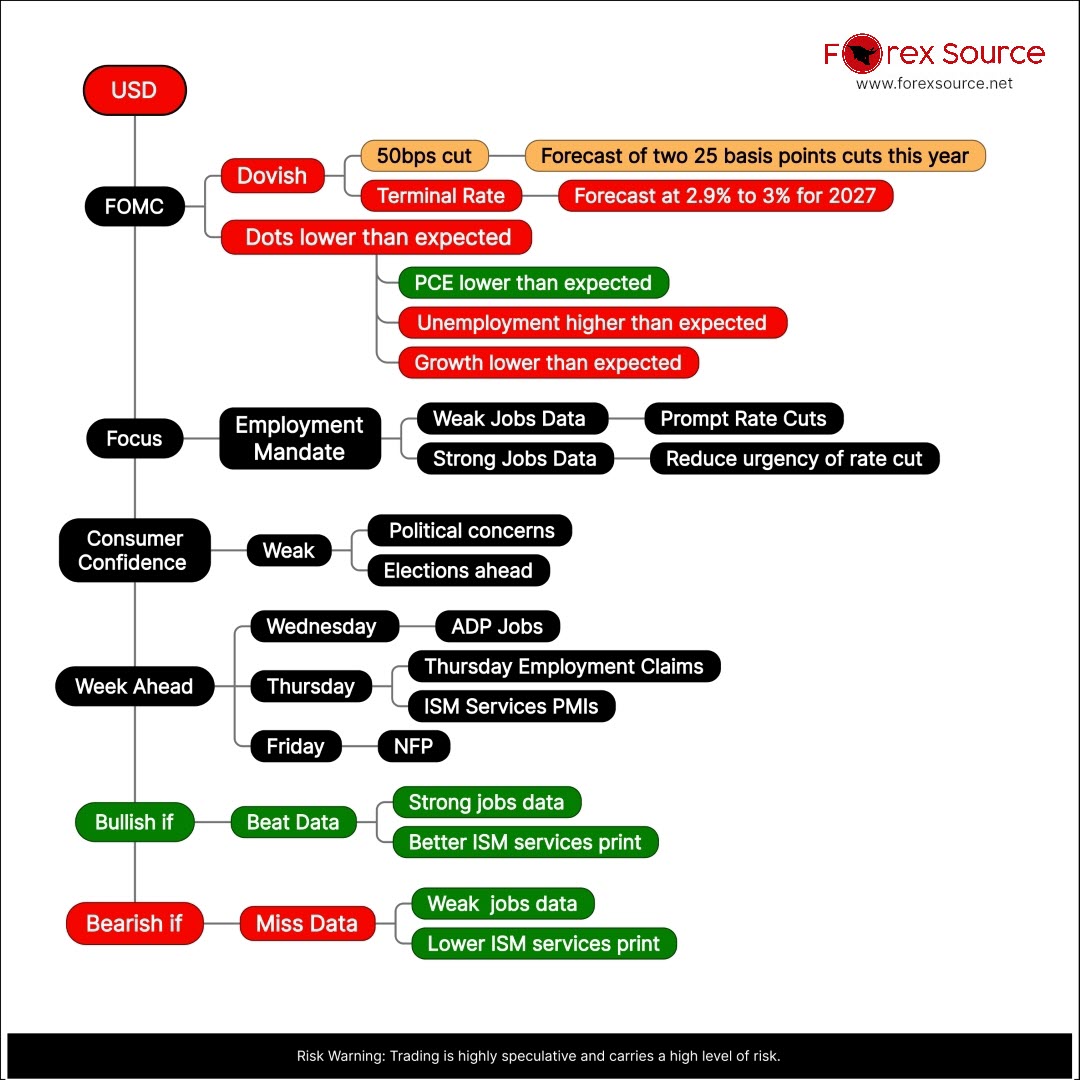

Federal Reserve's Influence on Market Expectations

The Federal Reserve's recent strategies indicate a significant shift in focus. Speeches by Fed Chair Jerome Powell have set the stage for a rate-easing cycle, with the Federal Open Market Committee (FOMC) expected to initiate a rate cut of at least 25 basis points in September. This shift prioritizes supporting the labor market over inflation control, often referred to in market circles as a "Fed put."

[shortcode-usuxmrhr]

[shortcode-xsqku6wk]

[shortcode-a14kmbl9]

[shortcode-uouyudzu]

The RBA's Cautious Approach

Across the Pacific, the Reserve Bank of Australia (RBA) maintains a hawkish stance under Governor Michele Bullock's leadership. While it's deemed premature to consider rate cuts, market expectations suggest a potential easing by year-end, reflecting mixed sentiment within the region.

[shortcode-uia7k5it]

Economic Concerns in Germany

Germany's economy, the largest in the Eurozone, continues to face headwinds. Recent data confirms a 0.1% contraction in Q2 2024, intensifying fears of a recession. Such economic strains pose significant challenges for the European Central Bank (ECB) as it considers future policy actions.

ECB's Gradual Policy Easing

Klaas Knot, a key official within the ECB, has indicated a willingness to gradually ease policies, contingent upon achieving a disinflation path aligned with the 2% target by the end of 2025. However, he stresses the importance of data-driven decisions, especially regarding a potential rate cut in September.

FX Market Update:

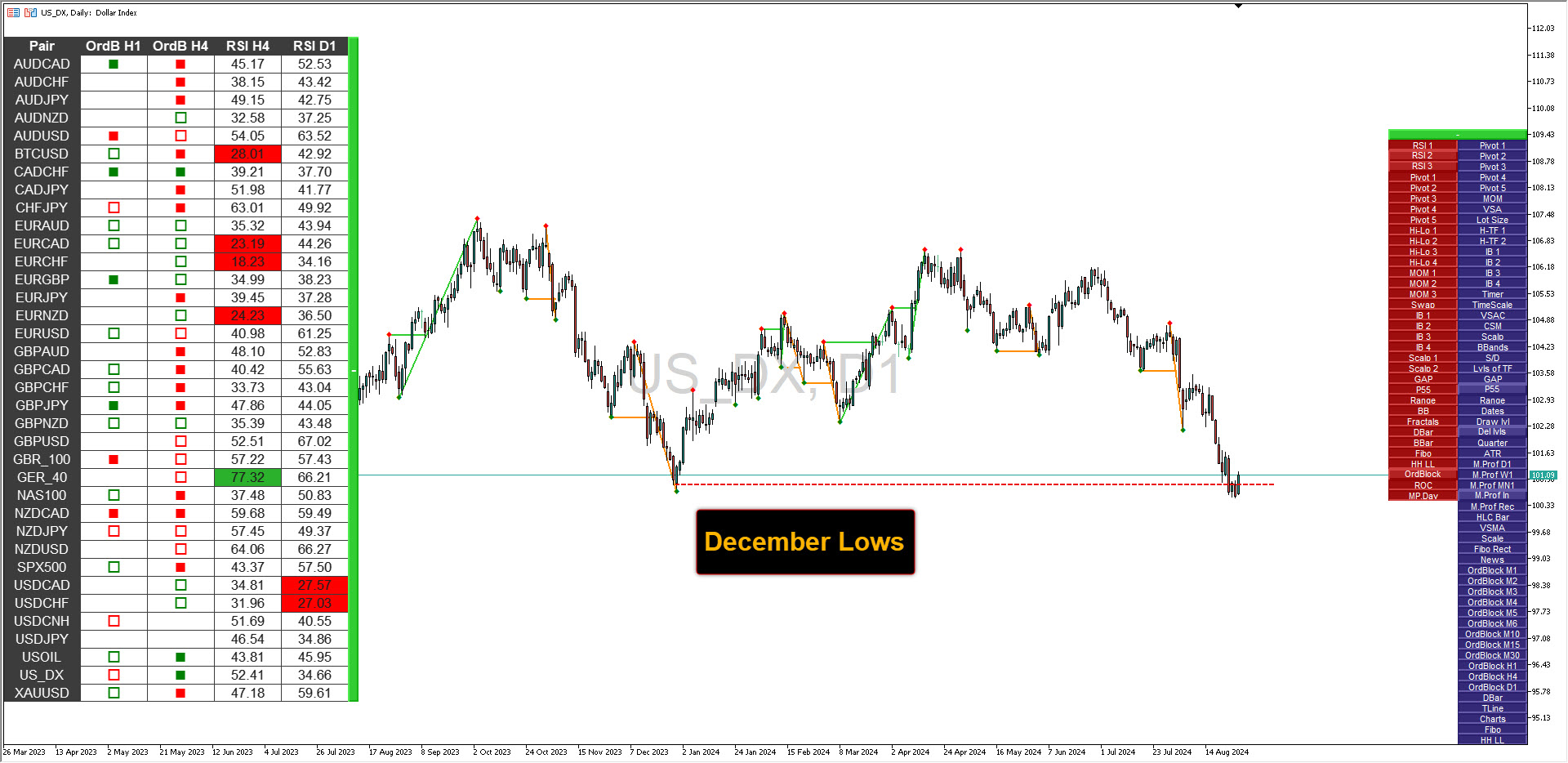

- The currency market has been equally dynamic. The US Dollar (USD) exhibits broad weakness, with the DXY index falling to 100.5, approaching last December's support level. Meanwhile, the British Pound (GBP) has surged to a new two-year high, exceeding 1.3260 against the USD.

- In contrast, the New Zealand Dollar (NZD) has outperformed major currencies without clear catalysts, reaching a seven-month high of just over 0.6250. Although the Australian Dollar (AUD) remains stable, it struggles to surpass the 0.68 resistance level.

- While the Federal Reserve is expected to cut rates steadily into 2025, the Bank of England might adopt a more cautious approach, potentially pausing during its next meeting in September.

- Attention on Friday's PCE data. Additionally, focus is directed toward next week’s NFP report.The September 6th payroll report will be pivotal in determining the strength and timing of the Fed’s policy adjustments.

[shortcode-gmi1bgas]

[shortcode-cjrqoat5]

[shortcode-tgnsgqe0]

- Potential Fed rate cuts are anticipated following comments from Fed officials like Daly and Powell suggesting easing policy.

Recently Blog