Research & Analysis

US Dollar Rebound and Global Rate Changes

- 2024-09-01

- Share On:

-

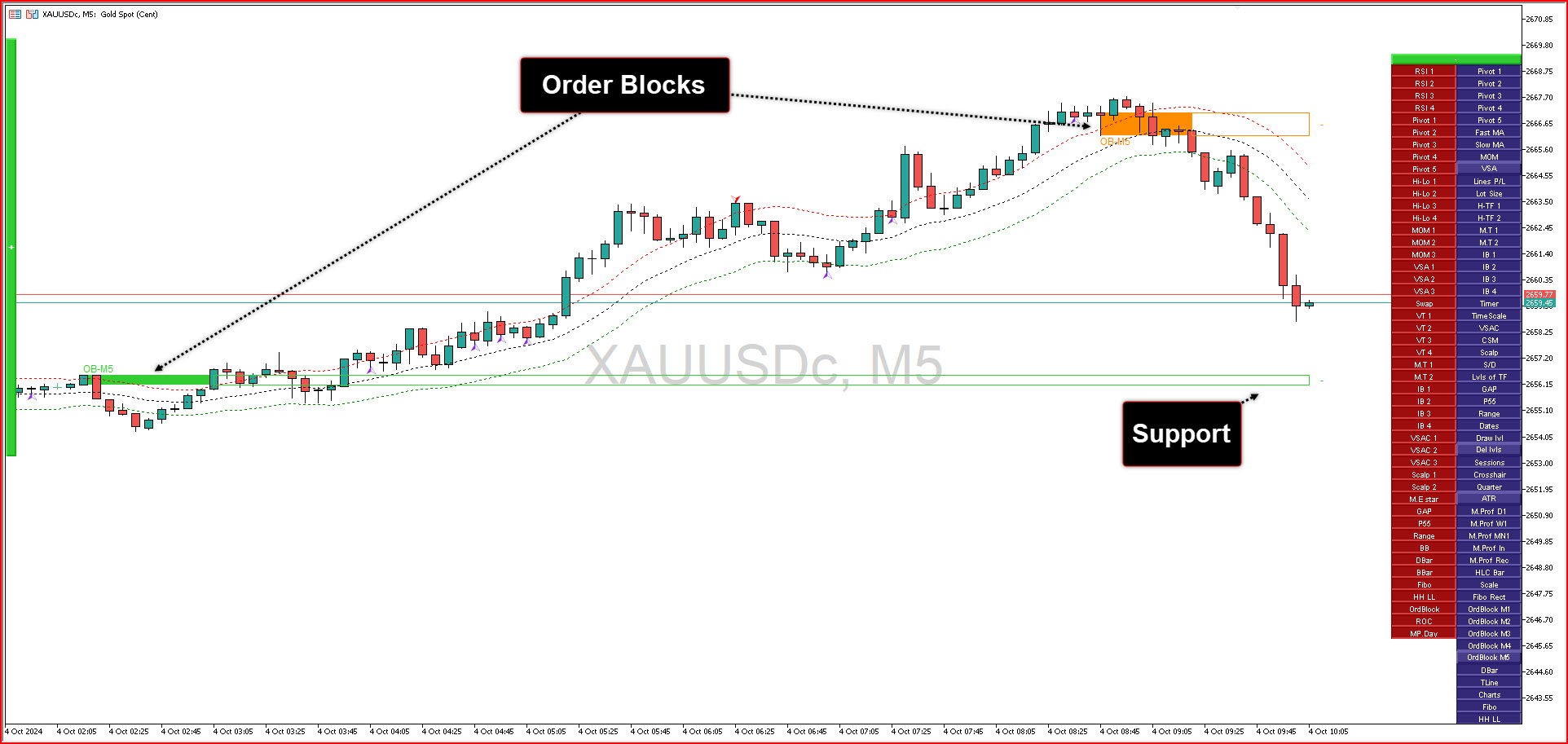

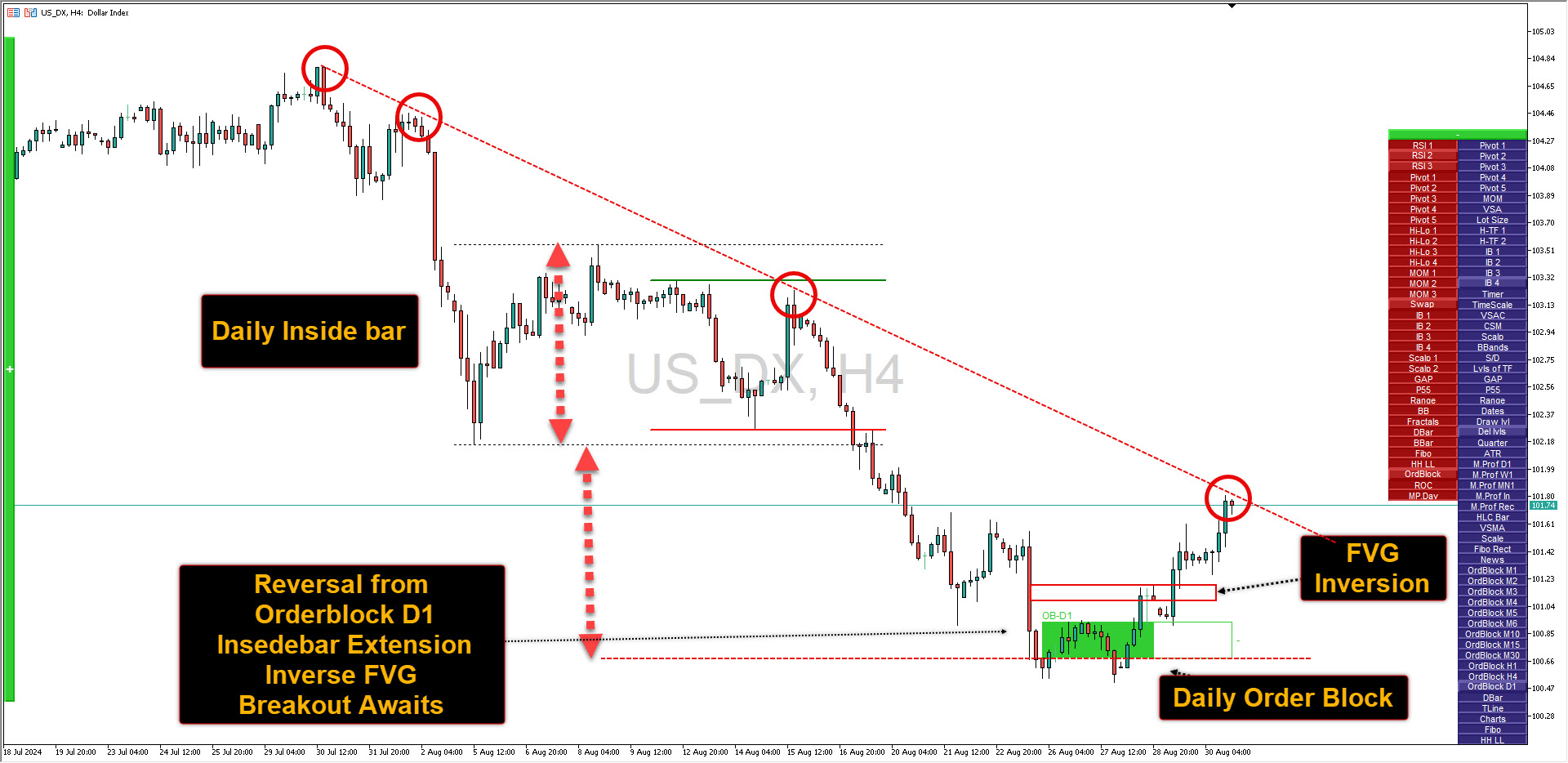

US Dollar Index (DXY)

The US Dollar saw a rebound after hitting 13-month lows, increasing from around 100.50 to over 101.00 by the end of the week.

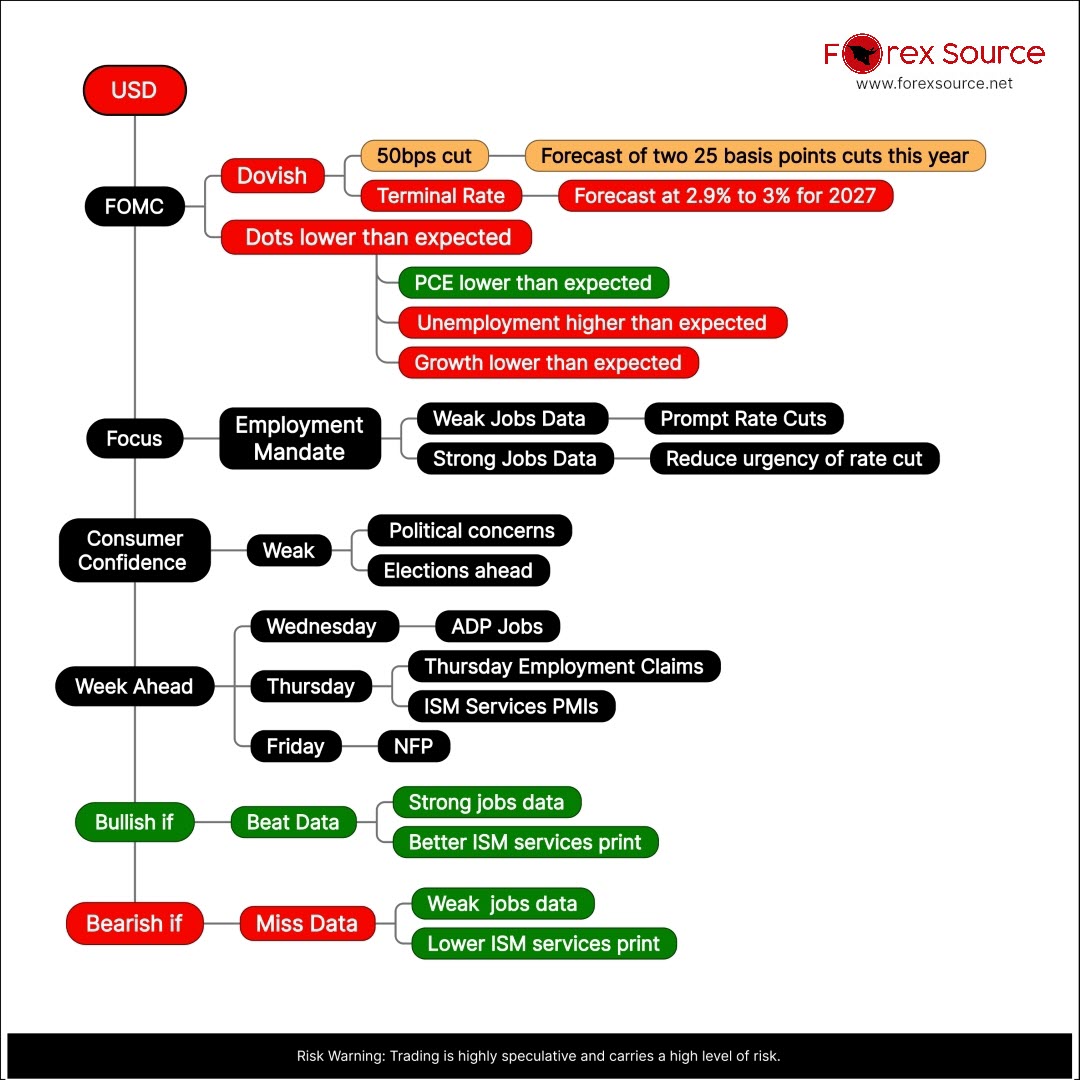

Federal Reserve Rate Cut Expectations:

[shortcode-usuxmrhr]

Growing anticipation that the Federal Reserve (Fed) will reduce interest rates, possibly beginning in September.

A 25 basis point (bps) cut is more likely, though a 50 bps cut could occur if economic conditions worsen.

US Economic Indicators:

Recent US economic data have shown strong fundamentals.

Concerns exist about the US job market, with Fed officials indicating that interest rate reductions might be necessary.

[shortcode-cjrqoat5]

[shortcode-uouyudzu]

[shortcode-a14kmbl9]

Global Monetary Policy Trends:

The European Central Bank and the Swiss National Bank recently cut rates by 25 bps.

The Bank of Japan increased rates by 15 bps.

The Bank of England also cut rates by a quarter-point, while the Reserve Bank of Australia maintained a steady rate, signaling potential easing in 2024.

Upcoming Key Events:

Important economic data releases next week include the Nonfarm Payrolls, ADP report, Initial Jobless Claims, and other indices.

Recently Blog